Starting January 1, 2026, excise duty rates on tobacco products and alcohol in Estonia will rise by 10 percent and such tax increases typically lead to higher retail prices.

Although both tobacco and alcohol excise duty rates were higher this year than last, tobacco excise revenue over the first 10 months of the year came in €1.7 million higher than during the same period in 2024. Revenue from alcohol excise, on the other hand, was lower year-over-year, largely due to stockpiling at the end of last year.

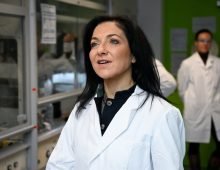

According to Jekaterina Nikitina, head of the Tax and Customs Board’s excise department, the bulk of that stockpiling involved spirits, which also account for the largest share of excise revenue. In terms of consumption, the quantities released for sale have not decreased year-on-year.

“In our work, we primarily follow the Ministry of Finance’s forecasts, which are adjusted throughout the year. This year, tobacco excise revenue came in as expected. Alcohol excise revenue is still somewhat below forecast, but that’s mainly due to the stockpiling effect,” she said.

An increase in excise duty always brings with it the risk that more people may seek cheaper or even illegal alternatives.

Read more: ERR.EE